Sbi Bank Savings Account Interest Rate 2021

SBI Savings Account Interest Rates & Minimum Balance requirements are some details that a customer seeks for while opening a savings account in State Bank of India. So, we have written an article to make you know about the SBI interest rates on saving account and charges for not maintaining minimum balance in SBI savings account.

SBI Interest Rates on Savings Account

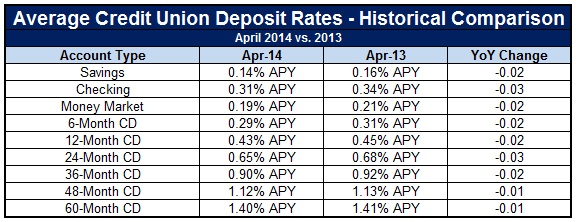

Business Savings Account Business Savings Account. SUB Services How to open an account with the State Bank of India UK Ltd. How to open an account with SBI UK Ltd. Protecting Your Money; Procurement News; Tools. Term Minimum Deposit to Open & Obtain APY Interest Rate APY Interest Frequency Early Withdrawal Penalty; 12 Month: $10,000.00: 0.37%: 0.37%: 91 Days: 91 Days.

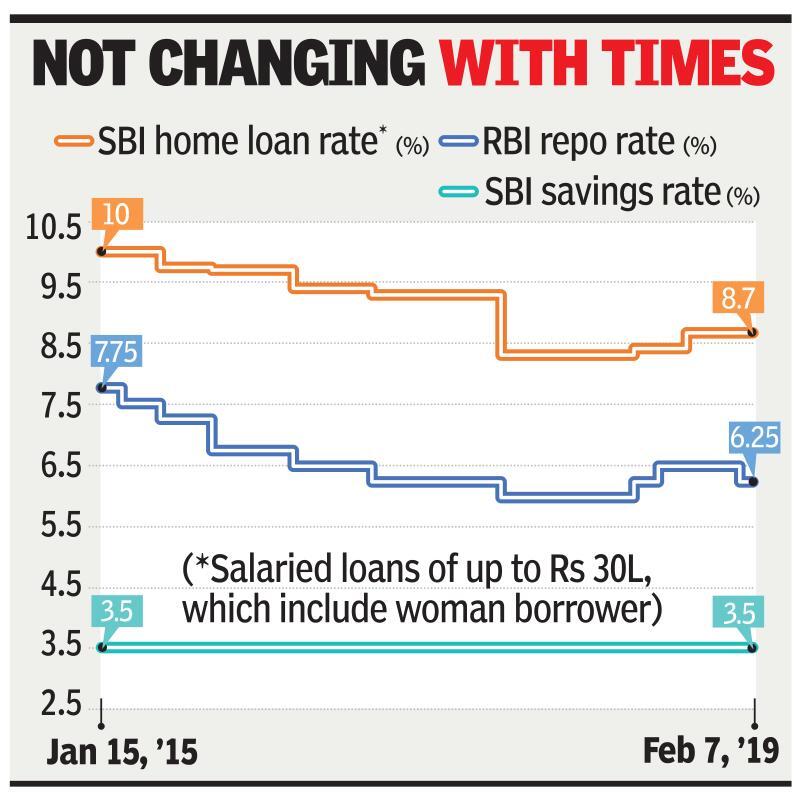

State Bank of India is one of the most reputed banks which provides you an interest rate of 3.5% on cash below Rs 1 lakh and an interest rate of 4% on cash above Rs 1lakh which is a standard rate of interest that any bank applies which can obviously change with time. There are safe lockers available for the customers according to the requirements, auto sweep facility, nomination facilities which is generally provided by almost all the banks in these days, mobile and internet banking facilities as well for the customers.

There is availability of health insurance cover as well provided by the banks for accidents and health covers which almost all the living being needs in case any mishap occurs to them and to ensure a proper living for their family. These extended facilities compel a customer to open their bank account in this bank.

Click Here: Best Banking Blogs To Follow

SBI Savings Account Minimum Balance Requirement

The state bank of India is an Indian multinational , public sector bank. It is a government bank. The state bank of India offers different minimum balance requirement for different branches. There are mainly three type of branches of state bank of India. Metro or urban branches, semi – urban branches, rural branches are the different branches of state bank of India. Metro or urban branch of state bank of India offers Rs. 3000 as minimum balance for savings accounts of customers. Semi urban branches of state bank of India offers Rs.2000 as minimum balance requirement for savings account of customers. Rural branches of state bank of India offers Rs.1000 as minimum balance requirement for savings account of customers. These are the three minimum balance requirements offered by different branches of state bank of India.

10 Benefits of opening a savings account in SBI

The government organization stands at 236thposition in the fortune global 500 list and has its headquarters in Mumbai,Maharashtra. It has the largest market share in India contributing up to 23% ofthe total shares. SBI gives a scope of banking items through their immensesystem of branches in India and abroad. The State Bank Group, with more than16,000 branches, has the biggest financial branch arrange in India. The Statebank of India is among the top 10 companies of India according to Forbes. Hereare a few pros of depositing money in state bank of India:

1. Loans

SBI gives loans to a wide range of people including pensioners, salaried employs, loans against securities and many more. Retired people can apply for loans under SBI personal loan for children's marriage, medical aids, dream home and many more. For employs earning standard salary, the loan's documentation is minimized and has the quickest approval process. SBI personal loan are offered at alluring financing costs to a changed client base. The one-time credit handling expense is ostensible and the reimbursement residency can go as long as 5 years.

Read Also: Top 10 Banks to get an instant personal loan

2. SBI Internet Banking

The internet banking portal of SBI allows its customers to work and do transactions from anywhere at appoint of time. This feature helps its customers to work with ease through internet. SBI has an exceptionally secure web banking entrance known as OnlineSBI which gives online administrations to both retail and corporate clients. The application has been improved with the most accurate creative ideas and equipments. A portion of the fundamental points of interest of SBI Net Banking are:

- Record articulations can be created on the web.

- Assets can be moved effectively.

- Bill can be paid effectively.

3. The YONO App

YONO (You Only Need One) is a coordinated computerized banking stage offered by State Bank of India (SBI) to empower clients to get to an assortment of money related and different administrations, for example, flight, train, transport and taxi appointments, web based shopping, or doctor's visit expense payments. YONO is offered as a cell phone application for both Android and iOS. The YONO was brought into existence on Friday 24 November 2017 by Arun Jaitley, the Finance Minister of India. YONO offers administrations from more than 60 web based business organizations including internet shopping, travel arranging, taxi booking, train booking, movie ticket booking, online training and disconnected retail with uncommon limits. YONO also allows us to do regular activities , for example, bank account opening, finance moves, cashless bill installments, and advances. The mobile app also allows us to withdraw money from ATMs at any point of time.

Read Also: What are the benefits of life insurance policy?

4. Online Money Safety

Being an SBI customer and using its online benefits reduces the risk of being targeted by hackers and online frauds.sbi gives specific and clarified rules and tips which when followed by customers will surely increase the safety of their money. Even though having more than 42 crore customers, SBI still ensures safety of their customers by making strict rules and regulations. Online fraudsters somehow convince the customers into getting their personal bank details and then robbing their money. Hence, SBI clearly states that no SBI agent will ask for the customers personal bank details so that their customers can be aware of fraudsters.

Read Also: Top 10 Banks to get a new or used car loan

5. Largest Bank Network

State bank of India has largest and widest network of banks in India with over 15000 branches all over India. This implies that even the most remote villages of India have an ATM or a branch office. SBI accomplished its objective of offering its full scope of features and administrations to every one of its branches and clients, spreading monetary development to country territories and giving money related incorporation to the entirety of India's residents. This large number of branches of the bank SBI allows its customers to be in a reachable range anywhere and anytime making it very convenient for their customers. The Bank is racing ahead with forefront innovation and imaginative new financial models, to grow its range. With 51,808 skillet India ATMs supplementing its branch arrange, State Bank of India today offers one of the biggest financial system to the Indian client.

6. Robust Core Banking System

The State Bank of India (SBI) chose TCS BaNCS to tweak the product, actualize the new center framework and give continuous operational help to its unified data innovation.

The usage of Core Banking arrangement from TCS BaNCS at SBI and its subsidiary banks speaks to the biggest brought together center framework execution at any point embraced.

The general exertion incorporated the change of around 140 million records held at 14,600 local offices of SBI and its member banks. The implementation of SBI's center financial arrangement was a colossal assignment for the IT group. It was basic for all partners to comprehend the size and intricacy of the center financial arrangement venture with the end goal for it to be effective. The information identified with clients and their exchanges was dispersed over every one of the branches which should have been relocated to the brought together database. Also, there were particular branches having their own arrangement of prerequisites because of the specific idea of their organizations. Likewise, there were functionalities which were not promptly accessible in BaNCS—the center financial arrangement—so these must be created. In addition, the incorporation required was of the specialized frameworks as well as of different business frameworks and procedures over the bank.

Read Also: Benefits of health insurance policy

7. Transparent System

SBI's association with its partners is based on the establishment of trust and satisfying our good and moral commitments. Client assistance has continuously been the Bank's essential concern and it is basic that we meet, however surpass client desires. Our qualities envelop characteristics of administration, straightforwardness, morals and graciousness which are all implanted in our endeavors to guarantee client delight. Giving back to the general public and working for the welfare of the oppressed is imbued inside SBI's corporate ethos.

Indeed before the Government's CSR order became effective, the Bank contributed essentially to network improvement. Concentrating on select regions, for example, instruction, aptitude improvement, ladies strengthening, maintainability and condition, the Bank's CSR activities are intended to make long term benefits. The Bank accepts that it has an incredible task to carry out in country building. We understand that India is changing at an extraordinary pace. As caretakers of the country's riches, it is our obligation to direct this change inthe correct bearing and make it more economical.

8. Different types of savings account

The state bank of India provides different saving accounts like:

Sbi Bank Savings Account Interest Rate 2021

SBI Savings Account Interest Rates & Minimum Balance requirements are some details that a customer seeks for while opening a savings account in State Bank of India. So, we have written an article to make you know about the SBI interest rates on saving account and charges for not maintaining minimum balance in SBI savings account.

SBI Interest Rates on Savings Account

Business Savings Account Business Savings Account. SUB Services How to open an account with the State Bank of India UK Ltd. How to open an account with SBI UK Ltd. Protecting Your Money; Procurement News; Tools. Term Minimum Deposit to Open & Obtain APY Interest Rate APY Interest Frequency Early Withdrawal Penalty; 12 Month: $10,000.00: 0.37%: 0.37%: 91 Days: 91 Days.

State Bank of India is one of the most reputed banks which provides you an interest rate of 3.5% on cash below Rs 1 lakh and an interest rate of 4% on cash above Rs 1lakh which is a standard rate of interest that any bank applies which can obviously change with time. There are safe lockers available for the customers according to the requirements, auto sweep facility, nomination facilities which is generally provided by almost all the banks in these days, mobile and internet banking facilities as well for the customers.

There is availability of health insurance cover as well provided by the banks for accidents and health covers which almost all the living being needs in case any mishap occurs to them and to ensure a proper living for their family. These extended facilities compel a customer to open their bank account in this bank.

Click Here: Best Banking Blogs To Follow

SBI Savings Account Minimum Balance Requirement

The state bank of India is an Indian multinational , public sector bank. It is a government bank. The state bank of India offers different minimum balance requirement for different branches. There are mainly three type of branches of state bank of India. Metro or urban branches, semi – urban branches, rural branches are the different branches of state bank of India. Metro or urban branch of state bank of India offers Rs. 3000 as minimum balance for savings accounts of customers. Semi urban branches of state bank of India offers Rs.2000 as minimum balance requirement for savings account of customers. Rural branches of state bank of India offers Rs.1000 as minimum balance requirement for savings account of customers. These are the three minimum balance requirements offered by different branches of state bank of India.

10 Benefits of opening a savings account in SBI

The government organization stands at 236thposition in the fortune global 500 list and has its headquarters in Mumbai,Maharashtra. It has the largest market share in India contributing up to 23% ofthe total shares. SBI gives a scope of banking items through their immensesystem of branches in India and abroad. The State Bank Group, with more than16,000 branches, has the biggest financial branch arrange in India. The Statebank of India is among the top 10 companies of India according to Forbes. Hereare a few pros of depositing money in state bank of India:

1. Loans

SBI gives loans to a wide range of people including pensioners, salaried employs, loans against securities and many more. Retired people can apply for loans under SBI personal loan for children's marriage, medical aids, dream home and many more. For employs earning standard salary, the loan's documentation is minimized and has the quickest approval process. SBI personal loan are offered at alluring financing costs to a changed client base. The one-time credit handling expense is ostensible and the reimbursement residency can go as long as 5 years.

Read Also: Top 10 Banks to get an instant personal loan

2. SBI Internet Banking

The internet banking portal of SBI allows its customers to work and do transactions from anywhere at appoint of time. This feature helps its customers to work with ease through internet. SBI has an exceptionally secure web banking entrance known as OnlineSBI which gives online administrations to both retail and corporate clients. The application has been improved with the most accurate creative ideas and equipments. A portion of the fundamental points of interest of SBI Net Banking are:

- Record articulations can be created on the web.

- Assets can be moved effectively.

- Bill can be paid effectively.

3. The YONO App

YONO (You Only Need One) is a coordinated computerized banking stage offered by State Bank of India (SBI) to empower clients to get to an assortment of money related and different administrations, for example, flight, train, transport and taxi appointments, web based shopping, or doctor's visit expense payments. YONO is offered as a cell phone application for both Android and iOS. The YONO was brought into existence on Friday 24 November 2017 by Arun Jaitley, the Finance Minister of India. YONO offers administrations from more than 60 web based business organizations including internet shopping, travel arranging, taxi booking, train booking, movie ticket booking, online training and disconnected retail with uncommon limits. YONO also allows us to do regular activities , for example, bank account opening, finance moves, cashless bill installments, and advances. The mobile app also allows us to withdraw money from ATMs at any point of time.

Read Also: What are the benefits of life insurance policy?

4. Online Money Safety

Being an SBI customer and using its online benefits reduces the risk of being targeted by hackers and online frauds.sbi gives specific and clarified rules and tips which when followed by customers will surely increase the safety of their money. Even though having more than 42 crore customers, SBI still ensures safety of their customers by making strict rules and regulations. Online fraudsters somehow convince the customers into getting their personal bank details and then robbing their money. Hence, SBI clearly states that no SBI agent will ask for the customers personal bank details so that their customers can be aware of fraudsters.

Read Also: Top 10 Banks to get a new or used car loan

5. Largest Bank Network

State bank of India has largest and widest network of banks in India with over 15000 branches all over India. This implies that even the most remote villages of India have an ATM or a branch office. SBI accomplished its objective of offering its full scope of features and administrations to every one of its branches and clients, spreading monetary development to country territories and giving money related incorporation to the entirety of India's residents. This large number of branches of the bank SBI allows its customers to be in a reachable range anywhere and anytime making it very convenient for their customers. The Bank is racing ahead with forefront innovation and imaginative new financial models, to grow its range. With 51,808 skillet India ATMs supplementing its branch arrange, State Bank of India today offers one of the biggest financial system to the Indian client.

6. Robust Core Banking System

The State Bank of India (SBI) chose TCS BaNCS to tweak the product, actualize the new center framework and give continuous operational help to its unified data innovation.

The usage of Core Banking arrangement from TCS BaNCS at SBI and its subsidiary banks speaks to the biggest brought together center framework execution at any point embraced.

The general exertion incorporated the change of around 140 million records held at 14,600 local offices of SBI and its member banks. The implementation of SBI's center financial arrangement was a colossal assignment for the IT group. It was basic for all partners to comprehend the size and intricacy of the center financial arrangement venture with the end goal for it to be effective. The information identified with clients and their exchanges was dispersed over every one of the branches which should have been relocated to the brought together database. Also, there were particular branches having their own arrangement of prerequisites because of the specific idea of their organizations. Likewise, there were functionalities which were not promptly accessible in BaNCS—the center financial arrangement—so these must be created. In addition, the incorporation required was of the specialized frameworks as well as of different business frameworks and procedures over the bank.

Read Also: Benefits of health insurance policy

7. Transparent System

SBI's association with its partners is based on the establishment of trust and satisfying our good and moral commitments. Client assistance has continuously been the Bank's essential concern and it is basic that we meet, however surpass client desires. Our qualities envelop characteristics of administration, straightforwardness, morals and graciousness which are all implanted in our endeavors to guarantee client delight. Giving back to the general public and working for the welfare of the oppressed is imbued inside SBI's corporate ethos.

Indeed before the Government's CSR order became effective, the Bank contributed essentially to network improvement. Concentrating on select regions, for example, instruction, aptitude improvement, ladies strengthening, maintainability and condition, the Bank's CSR activities are intended to make long term benefits. The Bank accepts that it has an incredible task to carry out in country building. We understand that India is changing at an extraordinary pace. As caretakers of the country's riches, it is our obligation to direct this change inthe correct bearing and make it more economical.

8. Different types of savings account

The state bank of India provides different saving accounts like:

SBI savings plus account

This is an extraordinary kind of reserve funds financial balance that is connected to MODS or Multi-Option Deposit Scheme, an ‘auto clear' office. In MODS, surplus reserve over an edge limit from the investment funds financial balance is moved consequently to term stores – or fixed stores (FD) – opened in products of Rs. 1,000.

SBI basic saving account

Bank Rates On Savings Accounts

SBI's essential investment funds financial balance is a sort of reserve funds ledger that is liberated from any base equalization necessity. That implies a client holding a fundamental investment funds financial balance with SBI isn't required to keep up a specific normal equalization consistently

SBI small saving account

Those holding a little investment funds financial balance with SBI are likewise not required to meet the bank's month to month normal equalization necessities. Nonetheless, the little bank account permits a greatest equalization of Rs 50,000, as per the SBI site. SBI permits Rs 10,000 as the most extreme total all things considered and moves in a month in its little bank account.

Sbi Rate Of Interest

Click Here: Best Bank for opening a Savings account

9. Credit Cards

SBI Card offers a wide scope of charge cards with unequaled advantages, limits and arrangements. One can discover a SBI charge card for shopping, eating, travel or films to meet his/her particular prerequisites. All SBI Visas give magnificent advantages to clients as remunerations, cashback, air terminal parlor get to and much more. The electronic record keeping of the sbi credit card that accompanies Mastercards make it simple to follow your spending and recognize fraud. On the off chance that you get hit with a startling cost, sbi credit card can be the snappy and simple arrangement you need. Responsible utilization of a Mastercard after some time fabricates your record of loan repayment, qualifying you for better loan costs and other monetary advantages.

10. Interest

State Bank Of India (sbi) Savings Account Interest Rate

SBI charges a financing cost of 3.5 percent per annum on sparing stores balance up to Rs 1 crore. Sparing stores balance above Rs 1 crore charges 4 percent for every annum loan costs. Investment funds Bank record can likewise be connected to Multi Option Deposit (MOD) represent gaining higher term store enthusiasm on surplus cash. Under bank account, SBI additionally offers unique compensation represents representatives of corporates, schools, schools, colleges, government foundations/associations, railroads, police foundations, resistance faculty, etc.